Week in Perspective Key Statistics (week-over-week)

Ending April 18, 2014

| Weekly Change | YTD |

MSCI World Index (USD) | 2.0% | 0.6% |

S&P 500 Index (USD) | 2.7% | 0.9% |

S&P/TSX Composite Index | 1.7% | 6.5% |

MSCI Europe Index (EUR) | 1.2% | 1.1% |

MSCI Emerging Market Index (USD) | -0.4% | 0.9% |

Hang Seng (HKD) | -1.1% | -2.3% |

Topix Index (JPY) | 3.5% | -9.9% |

| ||

| Current | Previous Week |

CAD/USD | $0.9071 | $0.9107 |

EUR/USD | $1.3813 | $1.3885 |

USD/JPY | ¥102.43 | ¥101.62 |

10-Year US Treasury Yield | 2.72% | 2.62% |

10-Year GoC Yield | 2.45% | 2.40% |

Gold USD/oz. | $1294.30 | $1318.42 |

Oil USD/bbl. | $104.30 | $103.74 |

Source: Bloomberg

Returning to the Past for the Sake of Our Future

Equity markets north and south of the border closed higher on the holiday shortened week last week, regaining lost ground from the prior week. The S&P 500 Index gained 2.7% (USD) to close within 1.3% of its April 2nd all-time high while the S&P/TSX Composite Index gained 1.7% to close at a level not seen since June 2008. Interestingly, while the S&P 500 Index has gained 20.7% from its pre-recession high reached in October 2007, the S&P/TSX Composite Index is still 3.8% away from its pre-recession (or all-time) high reached in June 2008.

Encouraging signs from the US labour market have been contributing to the market's resiliency in recent weeks. First-time jobless claims of 304,000 were reported last week, a marginal increase from the revised 302,000 reported the week prior. These are levels (including the 4-week moving average) that have not been seen since prior to the Great Recession and are a positive sign that the labour market continues to improve. If these levels hold, and do not see sharp revisions due to the Easter holidays, they would imply another month of job gains greater than 200,000 and confirm that the weaker jobs and related economic data over the winter were in fact, weather related.

Our contention has been that equity markets should experience another year of positive returns against a backdrop of valuations that would fall in the fair-value range and an economy that shows no signs of recession. Negative equity markets tend to correspond with recessionary periods. In absence of economic weakness we would put the greater probability on another positive year.

Cult of Equity

On another note, but not entirely unrelated, I have been re-visiting the memos, speeches and pension investment philosophy of George Ross Goobey. For those unfamiliar with Mr. Goobey, he was the manager of the Imperial Tobacco Pension Fund from 1947 to his retirement in the late 1970's. He is perhaps best known for establishing the "cult of equity" among pension plan managers in the 1950's. What I learned from Mr. Goobey are that the principles of pension investing are easily applied to personal retirement planning.

Investors, much like pension plans, have future income requirements that need to be met during retirement. Pension plan actuaries will assign a target rate of return necessary to meet its long-term liability requirements based on active/retired/future participants wage growth, inflation and mortality rates. In 1949 for the Imperial Tobacco Pension Fund this was 4%. Back in the late 1940's and early 1950's yields on UK 10-year gilts ranged between 2-4%.

The Best Possible Results

In a speech given to the Association of Superannuation and Pension Funds in 1956 Mr. Goobey argued whether "one should be content to invest (in government bonds) in order to earn that 3 or 3.5%, ... or whether one should endeavour to do better. If one so focuses one's attention on this agreed rate of interest, there seems to me to be an element of "working to rule", and I strongly deprecate that idea. My motto is: The best possible results."

A pension plan, or individual investor could invest merely in government bonds as a means to a retirement income end. However, in recognizing that future income needs will be impacted by inflation and as well that bond yields today may not accurately price or protect against future inflation, then it is up to us to endeavour to achieve the best possible results. From Mr. Goobey's perspective this meant investing in dividend paying stocks. His proposal was to shift the entire pension fund assets from bonds to 100% in equities, which was completed in the mid 1950's.

It is a very simple idea. Whereas bonds come with certain guarantees of income in the form of coupon and principal payments, they also come with a guarantee (for the most part) that an investor will never receive more income than the stated coupon (this assumes that there are no capital gains earned). With a dividend paying stock, there is no guarantee that a company will increase or even maintain the dividend, however there is at least the chance. And companies tend to have a degree of pricing power that over time can be exercised to keep prices and therefore earnings growing at least at the pace of inflation.

Dividend Growers

Mr. Goobey also highlighted the mistakes in assessing dividend paying equities merely by the current dividend yield. "The calculation of the yield of an Ordinary stock and share is not a simple matter, but a very simple device is used, and, unfortunately, I think it gives a very wrong impression." Here, Mr. Goobey down plays the current dividend yield of a stock in favour of estimating what the potential income might be over 30-40 years and relating that to the current price. In other words, favour dividend growers.

Let's say company X for example has a dividend yield today of 2.5%. If company X increases its dividend at an annual rate of 12% the yield on cost will double to 5% in six years. There are many companies that fall into this category. And in fact, it isn't difficult to find companies that have been paid dividends consistently for over 100 years and grown annually for over 25 years.

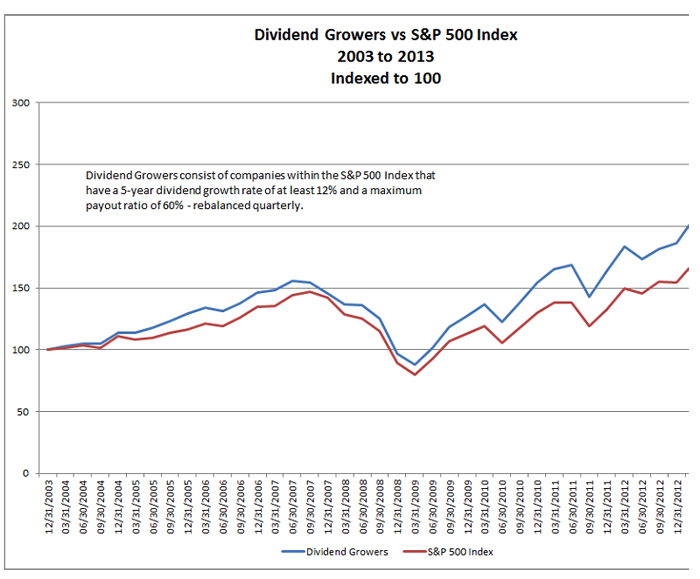

Using Bloomberg we screened the S&P 500 Index for companies with a 5-year dividend growth rate of at least 12% and a payout ratio of no more than 60%. This screen was back tested and rebalanced on a quarterly basis going back ten years to 12/31/2003. What we found was a portfolio of approximately 100 companies, an average quarterly turnover rate of 18.6% and a 10-year annualized performance of 9.93%. The S&P 500 Index returned 7.41% over the same period. These results assume all dividends are paid out an not reinvested.

Source: Bloomberg & Manulife Asset Management

Today we are faced with a demographic in North America, Japan and Europe that is aging and with large proportions in or near retirement. The need for income is paramount. Unfortunately, we are also in an environment in which government bonds offer low yields. Perhaps far lower than what would sustain a suitable retirement income. Further, if rates rise (which they are likely to do over time) that puts pressure on bond prices. Much like what was experienced in the 1950's through the following 30 years. Mr. Goobey recognized these issues in his time and found his solution in dividend equities. With companies sitting on record-levels of cash and more willing to return capital to shareholders in the form of increased dividends (or in some cases share buybacks), today's investors may also find a solution in dividend, and to be more specific, dividend growing equities.

This publication is intended for accredited investors in Canada only. This material may not be copied or used with the public. The opinions expressed are those of Manulife Asset Management™ as of April 2014, and are subject to change based on market and other conditions. The information in this document including statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife Asset Management™ disclaims any responsibility to update such information. All overviews and commentary are intended to be general in nature and for current interest. While helpful, these overviews are no substitute for professional tax, investment or legal advice. Clients should seek professional advice for their particular situation. Neither Manulife Financial, Manulife Asset Management™, nor any of their affiliates or representatives is providing tax, investment or legal advice. Past performance does not guarantee future results. This material was prepared solely for informational purposes, does not constitute an offer or an invitation by or on behalf of Manulife Asset Management™ to any person to buy or sell any security and is no indication of trading intent in any fund or account managed by Manulife Asset Management™.

Manulife Asset Management™ is the institutional asset management arm of Manulife Financial. Manulife Asset Management™ and its affiliates provide comprehensive asset management solutions for institutional investors and investment funds in key markets around the world. This investment expertise extends across a full range of asset classes including equity, fixed income and alternative investments such as real estate, timber, farmland, as well as asset allocation strategies. Manulife Asset Management™ has investment offices in the United States, Canada, the United Kingdom, Japan, Hong Kong, and eight other markets throughout Asia. Additional information about Manulife Asset Management™ may be found at ManulifeAM.com. Manulife Asset Management™, Manulife and the block design are trademarks of The Manufacturers Life Insurance Company and are used by it and its affiliates including Manulife Financial Corporation. Prior to December 15, 2010, Manulife Asset Management™ was known as MFC Global Investment Management®.